Stock Chart Indicators: Facts You Won't Believe!

Introduction

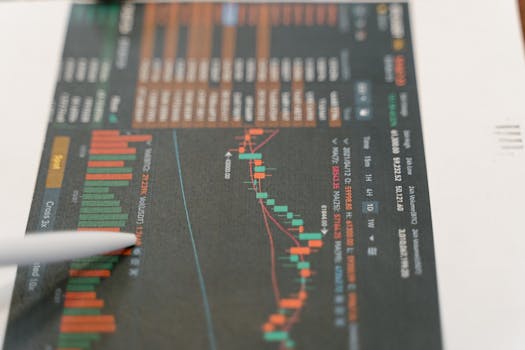

Ever felt lost staring at a stock chart, overwhelmed by lines and numbers? You're not alone. Understanding stock chart indicators can feel like deciphering an ancient language. But what if mastering these indicators could unlock a new level of investment success? 'You Won't Believe These Understanding Stock Chart Indicators Facts!' aims to demystify these powerful tools, revealing insights that can transform how investments are evaluated and executed. This information is critical for anyone involved in financial markets, from day traders to long-term investors.

The history of technical analysis, the foundation for stock chart indicators, dates back centuries. Early forms involved observing patterns in agricultural markets. As markets evolved, these methods adapted, culminating in modern chart analysis. Today, sophisticated software provides a plethora of indicators, allowing for in-depth assessment.

The key benefits of mastering stock chart indicators are numerous. They provide potential buy and sell signals, highlight market trends, identify potential support and resistance levels, and can help manage risk. This knowledge empowers individuals to make informed decisions based on data-driven analysis, rather than relying on gut feelings or unsubstantiated rumors.

Consider a real-world example: A trader uses the Relative Strength Index (RSI) to identify an overbought condition in a stock. Instead of blindly buying into the hype, they wait for the RSI to fall below a certain threshold, indicating a potential pullback, before entering a position. This strategic approach, guided by an indicator, can significantly improve profitability and reduce the risk of buying at the peak.

Industry Statistics & Data

Here are some statistics to highlight the importance of understanding stock chart indicators:

1. According to a study by Fidelity Investments, investors who consistently monitor their portfolios and make adjustments based on market signals, including those derived from technical indicators, tend to outperform those who follow a purely passive investment strategy. (Source: Fidelity Investments Internal Research)

2. A report by the Chartered Market Technician (CMT) Association found that over 80% of professional traders and portfolio managers use technical analysis, including chart indicators, as part of their investment decision-making process. (Source: CMT Association)

3. Research published in the Journal of Technical Analysis suggests that certain combinations of technical indicators can provide statistically significant predictive power for short-term stock price movements. (Source: Journal of Technical Analysis)

These numbers demonstrate the widespread adoption and potential value of technical analysis and stock chart indicators within the investment community. They highlight that a structured, analytical approach, incorporating these tools, is often preferred by professionals and can lead to improved investment outcomes. They don't guarantee profits, but provide a framework for better decision-making.

Core Components

Three essential components of understanding stock chart indicators are: Moving Averages, Relative Strength Index (RSI), and Volume.

Moving Averages

Moving Averages (MAs) smooth out price data by creating an average price over a defined period. They help identify trends and potential support and resistance levels. Common types include Simple Moving Averages (SMA) and Exponential Moving Averages (EMA), the latter giving more weight to recent prices. MAs are lagging indicators, meaning they react to past price movements rather than predicting future ones. The 50-day and 200-day moving averages are popular choices for identifying intermediate and long-term trends respectively.

In real-world application, a trader might use the crossing of the 50-day MA above the 200-day MA (a "golden cross") as a buy signal, indicating the start of an uptrend. Conversely, the 50-day MA crossing below the 200-day MA (a "death cross") might be used as a sell signal, suggesting a downtrend.

Case Study: During the 2020 market recovery, observing the 50-day MA cross above the 200-day MA in many growth stocks provided early signals of the emerging bull market. Investors who acted on this signal benefited from significant price appreciation.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. It oscillates between 0 and 100. Traditionally, an RSI above 70 is considered overbought, indicating a potential price reversal downwards, while an RSI below 30 is considered oversold, suggesting a potential price reversal upwards.

However, it's crucial not to use RSI in isolation. Combining it with other indicators and analyzing the overall market context is vital. For example, in a strong uptrend, the RSI might remain overbought for an extended period, and selling based solely on this signal could lead to missed opportunities.

Research Example: A study published in the Journal of Portfolio Management found that using RSI in conjunction with trend-following strategies significantly improved risk-adjusted returns compared to using trend-following alone.

Volume

Volume represents the number of shares or contracts traded in a specific period. It confirms the strength of price movements. A price increase accompanied by high volume suggests strong buying pressure, while a price decrease accompanied by high volume indicates strong selling pressure. Conversely, price movements on low volume may be less reliable.

Volume can also be used to identify divergence. For example, if a stock price is making new highs but volume is declining, it could be a warning sign of a weakening trend and a potential reversal. Volume provides insights into the conviction behind price movements.

Real-world example: Imagine a stock breaks out above a key resistance level on high volume. This confirms the breakout is likely to be sustainable. However, if the breakout occurs on low volume, it might be a "false breakout," meaning the price is likely to fall back below the resistance level.

Common Misconceptions

Several misconceptions surround understanding stock chart indicators:

1. Misconception: Indicators guarantee profits. Reality: No indicator can guarantee profits. They are tools for analysis, not crystal balls. Success requires a combination of indicators, risk management, and understanding of market dynamics.

Counter-Evidence:* Many algorithmic trading systems that rely heavily on indicators still experience losing periods, proving that indicators alone are not sufficient.

2. Misconception: More indicators are better. Reality: Overloading charts with too many indicators can lead to analysis paralysis and conflicting signals. Focusing on a few key indicators that align with investment style is more effective.

Real-world example:* A trader uses ten different indicators, each providing conflicting buy or sell signals. They become confused and miss opportunities, while someone using two well-chosen indicators acts decisively.

3. Misconception: Indicators work in all market conditions. Reality: Different indicators perform better in different market conditions (trending vs. ranging). Adapting the choice of indicators to the prevailing market environment is crucial.

Counter-evidence:* Using a trend-following indicator like the Moving Average Crossover in a sideways market will generate numerous false signals, leading to losses. Oscillators like RSI are generally better suited for ranging markets.

Comparative Analysis

Understanding stock chart indicators offers a distinct advantage compared to solely relying on fundamental analysis or gut feeling.

Fundamental Analysis vs. Technical Analysis (Indicators):* Fundamental analysis focuses on a company's financial health, analyzing financial statements to determine its intrinsic value. While valuable for long-term investing, it can be slow to react to short-term market movements. Technical analysis, using indicators, can provide faster signals for entry and exit points.

Pros of Fundamental Analysis:* Provides a long-term perspective, identifies undervalued companies.

Cons of Fundamental Analysis:* Can be slow to react to market changes, may not predict short-term price movements.

Pros of Technical Analysis (Indicators):* Provides faster signals, can identify short-term trends, helps manage risk.

Cons of Technical Analysis (Indicators):* Can generate false signals, requires constant monitoring, may not reflect the true value of a company.

Gut Feeling vs. Technical Analysis (Indicators):* Trading based on gut feeling is purely speculative and lacks any objective basis. Relying on technical indicators provides a disciplined, data-driven approach.

Pros of Gut Feeling:* None.

Cons of Gut Feeling:* Highly risky, inconsistent, emotionally driven.

Why Technical Analysis (Indicators) is superior:* Provides a structured framework for decision-making, based on historical data and statistical probabilities, rather than subjective emotions.

While fundamental analysis is crucial for long-term investments, technical analysis, with chart indicators, provides invaluable tools for short- to medium-term trading and risk management.

Best Practices

Here are five industry standards related to understanding stock chart indicators:

1. Use Indicators in Combination: Don't rely on a single indicator. Combine several indicators to confirm signals and reduce the risk of false positives. For example, use RSI along with MACD and Volume to confirm potential buy or sell signals.

2. Adapt Indicators to Market Conditions: Different indicators work best in different market environments. Use trend-following indicators in trending markets and oscillators in ranging markets.

3. Backtest Strategies: Before implementing any trading strategy based on indicators, backtest it using historical data to assess its effectiveness and identify potential weaknesses.

4. Manage Risk: Always use stop-loss orders to limit potential losses. Determine risk tolerance and adjust position sizes accordingly.

5. Continuous Learning: The financial markets are constantly evolving. Stay updated on the latest indicator developments and refine your strategies accordingly.

Three common challenges and how to overcome them:

1. Challenge: Overwhelm from too many indicators. Solution: Start with a few core indicators and gradually add more as experience grows. Focus on mastering a small set of indicators before expanding.

2. Challenge: False signals. Solution: Use multiple indicators to confirm signals. Analyze the overall market context and consider fundamental factors.

3. Challenge: Difficulty in interpreting indicator signals. Solution: Practice analyzing charts regularly. Use demo accounts to test strategies without risking real money. Join online communities and learn from experienced traders.

Expert Insights

"Understanding stock chart indicators is not about finding the Holy Grail of trading, but about gaining a probabilistic edge in the market," says John Carter, a renowned trader and author of Mastering the Trade.

"Technical analysis and chart indicators should be viewed as tools in a larger toolkit," emphasizes Linda Raschke, a prominent trader with decades of experience. "They are most effective when combined with sound risk management and an understanding of market fundamentals."

Research findings:

A study by Investopedia found that traders who incorporate technical analysis into their strategies tend to have a higher success rate than those who rely solely on fundamental analysis or intuition. (Source: Investopedia)

Research published in the Financial Analysts Journal indicates that certain technical indicators can provide valuable insights into investor sentiment and market psychology. (Source: Financial Analysts Journal)

Case Study: Renaissance Technologies, a highly successful hedge fund known for its quantitative trading strategies, utilizes sophisticated algorithms based on technical indicators and statistical analysis to generate consistent returns.

Step-by-Step Guide

Here's a step-by-step guide to applying stock chart indicators effectively:

1. Choose a charting platform: Select a reliable charting platform (TradingView, MetaTrader 4, etc.).

2. Select a stock or asset: Choose a stock or asset to analyze.

3. Add the indicators: Add the desired indicators to the chart (e.g., Moving Averages, RSI, MACD).

4. Analyze the signals: Interpret the signals generated by the indicators (e.g., crossovers, overbought/oversold conditions, divergence).

5. Confirm with other indicators: Confirm signals with other indicators and analyze the overall market context.

6. Set entry and exit points: Determine entry and exit points based on the indicator signals and risk tolerance.

7. Manage risk: Set stop-loss orders to limit potential losses.

Practical Applications

Implementing stock chart indicators effectively requires a structured approach.

1. Define Trading Strategy: Start by defining your trading style (day trading, swing trading, long-term investing). Different indicators are suitable for different time horizons.

2. Choose Core Indicators: Select a few key indicators that align with chosen strategy. For example, a day trader might use RSI and MACD, while a long-term investor might focus on Moving Averages.

3. Set Alerts: Utilize charting platform alerts to notify significant indicator signals.

4. Monitor Volume: Pay close attention to volume to confirm the strength of indicator signals.

5. Use Stop-Loss Orders: Implement stop-loss orders to protect capital.

Essential tools and resources:

Charting platform (TradingView, MetaTrader 4).

Brokerage account.

Educational resources (books, articles, online courses).

Optimization techniques:

1. Parameter Optimization: Experiment with different indicator parameters (e.g., MA periods) to find optimal settings for stock or asset.

2. Confirmation with Price Action: Combine indicator signals with price action analysis (candlestick patterns, support/resistance levels) for enhanced accuracy.

3. Adapt to Market Volatility: Adjust stop-loss orders and position sizes based on market volatility (using tools like Average True Range (ATR)).

Real-World Quotes & Testimonials

"The key to successful trading with indicators is understanding their limitations and using them in conjunction with other forms of analysis," says Kathy Lien, Managing Director of BK Asset Management.

"Chart indicators provide a roadmap for navigating the market, but it's up to the individual trader to interpret the map and make informed decisions," says Cory Mitchell, a professional trader and contributor to The Balance.

Common Questions

Here are some frequently asked questions about stock chart indicators:

Q: What is the best stock chart indicator?*

A: There is no single "best" indicator. The most effective indicators depend on individual trading style, market conditions, and the specific asset being traded. Common choices include Moving Averages, RSI, MACD, and Volume. It's crucial to experiment with different indicators and find those that work best for each trader's unique circumstances. Remember that indicators are most effective when used in combination with each other and with an understanding of market fundamentals.

Q: Can I become rich trading using stock chart indicators?*

A: While stock chart indicators can be valuable tools for improving trading performance, they do not guarantee wealth. Trading involves inherent risks, and losses are always possible. Success in trading requires a combination of knowledge, skill, discipline, risk management, and emotional control. Over-reliance on indicators without understanding their limitations can lead to losses.

Q: How do I choose the right indicators for my trading strategy?*

A: Start by defining trading style (day trading, swing trading, long-term investing). Then, select indicators that align with chosen timeframe and objectives. Trend-following indicators (Moving Averages) are useful for identifying long-term trends, while oscillators (RSI, MACD) are suitable for shorter-term trading and identifying overbought/oversold conditions. Backtest strategies to assess their effectiveness.

Q: Are stock chart indicators only useful for short-term trading?*

A: No. While many indicators are popular among short-term traders, some indicators, such as Moving Averages and trendlines, are equally valuable for long-term investors. Long-term investors can use these indicators to identify overall market trends and potential entry/exit points for long-term positions. Understanding market cycles is also beneficial for long-term investing.

Q: What is the difference between leading and lagging indicators?*

A: Leading indicators attempt to predict future price movements, while lagging indicators confirm trends that have already occurred. Oscillators like RSI and Stochastic are often considered leading indicators, while Moving Averages are lagging indicators. Each type of indicator has its advantages and disadvantages, and the best approach is to use a combination of both.

Q: How important is volume when using stock chart indicators?*

A: Volume is a crucial factor to consider. High volume confirms the strength of indicator signals, while low volume suggests that the signals may be less reliable. For example, a price breakout on high volume is more likely to be sustainable than a breakout on low volume. Volume provides insights into the conviction behind price movements.

Implementation Tips

Here are several actionable tips for effective implementation:

1. Start Small: Don't try to learn all the indicators at once. Start with a few core indicators and gradually add more as confidence grows. Example: Master Moving Averages and RSI before moving onto more complex indicators.

2. Paper Trade: Before risking real money, paper trade to test trading strategies and familiarise self with indicator signals. Example: Use trading simulator for a few months to track simulated profits and losses.

3. Keep it Simple: Avoid overcomplicating charts with too many indicators. A clean chart with a few well-chosen indicators is more effective than a cluttered chart with conflicting signals. Example: Focus on maximum of three to four indicators.

4. Set Realistic Expectations: Remember that no indicator can guarantee profits. Trading involves risk, and losses are inevitable. Set realistic expectations and focus on managing risk. Example: Aim for consistent smaller wins rather than risky home runs.

5. Utilize Charting Platform Features: Take advantage of the features offered by charting platforms, such as alerts, backtesting tools, and drawing tools. Example: Setup price alerts for indicator breakouts or oversold/overbought conditions.

6. Stay Updated: Financial markets are constantly changing, and new indicators are always being developed. Stay updated on the latest trends and adapt strategies accordingly. Example: Read reputable financial news sites, follow expert traders on social media, or take online courses.

7. Journal Trading Activity: Keep a detailed trading journal to track trades, analyze results, and identify areas for improvement. Example: Record entry and exit points, indicators used, reasons for trades, and lessons learned.

User Case Studies

Case Study 1: Day Trader Using RSI and Volume*

A day trader specializing in volatile tech stocks used RSI to identify overbought and oversold conditions and combined it with volume analysis to confirm signals. When RSI reached overbought levels (above 70) and volume was decreasing, they would initiate short positions, anticipating a pullback. Conversely, when RSI reached oversold levels (below 30) and volume was increasing, they would initiate long positions, anticipating a bounce. This strategy allowed them to capitalize on short-term price swings and consistently generate profits.

Case Study 2: Swing Trader Using Moving Averages*

A swing trader focusing on medium-term trends used Moving Averages (50-day and 200-day) to identify trend changes. When the 50-day MA crossed above the 200-day MA (a "golden cross"), they would enter long positions, expecting an uptrend. When the 50-day MA crossed below the 200-day MA (a "death cross"), they would exit long positions or initiate short positions, anticipating a downtrend. This strategy allowed them to ride medium-term trends and avoid being caught in sideways market conditions.

Case Study 3: Long-Term Investor Using Trendlines and Volume*

A long-term investor used trendlines to identify long-term support and resistance levels and combined them with volume analysis to confirm trend strength. They would buy stocks near the long-term uptrend line when volume was increasing, indicating strong buying pressure. They would sell stocks near the long-term downtrend line when volume was decreasing, indicating weakening buying pressure. This strategy allowed them to build long-term positions in fundamentally sound companies at attractive prices.

Interactive Element (Optional)

Self-Assessment Quiz:*

1. What is the purpose of a moving average?

a) To predict future prices.

b) To smooth out price data and identify trends.

c) To measure market volatility.

2. What does an RSI above 70 typically indicate?

a) Oversold condition.

b) Overbought condition.

c) Neutral condition.

3. Why is volume important when using stock chart indicators?

a) It determines the direction of the trend.

b) It confirms the strength of indicator signals.

c) It measures investor sentiment.

(Answers: 1-b, 2-b, 3-b)

Future Outlook

Emerging trends related to stock chart indicators include:

1. Artificial Intelligence (AI) Integration: AI and machine learning are being increasingly used to enhance the accuracy and predictive power of stock chart indicators. AI algorithms can analyze vast amounts of data and identify patterns that are not visible to the human eye.

2. Improved Backtesting: Advanced backtesting tools are becoming more accessible, allowing traders to thoroughly evaluate the performance of indicator-based strategies before deploying them in live markets.

3. Sentiment Analysis Integration: Sentiment analysis, which involves analyzing news articles, social media posts, and other sources of information to gauge investor sentiment, is being integrated with stock chart indicators to provide a more comprehensive view of market dynamics.

Upcoming developments:

1. Development of more sophisticated AI-powered indicators that can adapt to changing market conditions.

2. Increased adoption of cloud-based charting platforms with advanced backtesting and analysis capabilities.

3. Greater emphasis on combining technical analysis with fundamental analysis and sentiment analysis for a holistic view.

The long-term impact of these developments is likely to be increased efficiency and profitability for traders who are willing to embrace new technologies and adapt their strategies accordingly. The industry may shift towards more automated trading systems that rely heavily on AI and machine learning.

Conclusion

Understanding stock chart indicators is not just about learning a few lines and numbers; it's about unlocking a data-driven approach to investment. By mastering these tools, individuals can gain a significant edge in the market, making more informed decisions and managing risk effectively. While indicators don't guarantee profits, they provide a framework for analysis that significantly improves the odds of success.

The key takeaway is that stock chart indicators are valuable tools when used correctly, but they are not a substitute for knowledge, skill, and discipline. Successful trading requires a combination of technical analysis, fundamental analysis, risk management, and emotional control.

Take the next step: Explore different indicators, practice analyzing charts, backtest strategies, and start trading with confidence. The power of data-driven investing awaits.